When it comes to attracting employees to your company, you know competitive pay and benefits rank high on the list. But it may come as a surprise that boosting your financial wellness benefits can help you recruit—and retain—high performers across all generations, including millennials.

In 2015, the millennial generation (those 18–34 years old, sometimes called Gen Y) overtook baby boomers as the largest generation of employees in the workplace, making millennials the future of your business. The good news: they’re enthusiastic and ready to make their mark. The bad news: they’re often living paycheck to paycheck and it’s leading to significant stress that’s affecting their productivity on the job. Employers offering the support millennials need will be able to capitalize on the energy and talent of this powerful generation.

Millennials’ money woes

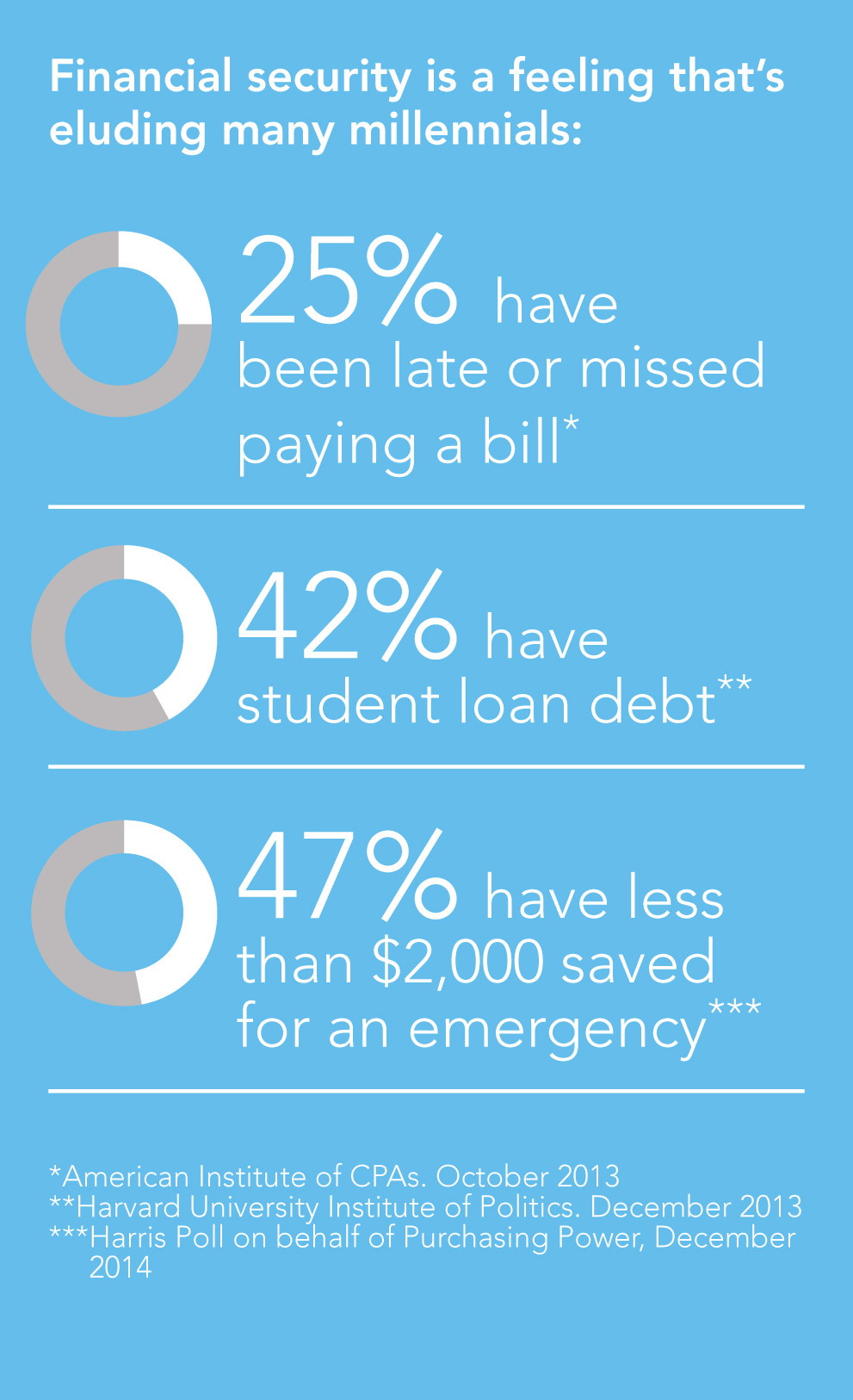

Despite their reputation for instant gratification, millennials are looking toward their financial futures. While their financial wellness lenses may not be focused as far off as retirement, many in this generation are concerned about their financial security. And for good reason:

Today’s unprecedented debt: The shortage of jobs and lower starting salaries that resulted from the Great Recession have delayed the income growth of young workers. Many are saddled with extensive debt. In fact, student loan debt in the U.S. is over $1 trillion, and millennials owe the lion’s share of it. Making those payments each month is straining millennials’ wallets now.

Tomorrow’s overwhelming needs: Millennials are equally troubled by how much to save for retirement. They expect to live longer in retirement than previous generations; a TIAA-CREF retirement survey found that 34% of millennials believe they’ll live 25 years or more in retirement. And 80% of millennials believe they won’t get any benefit from Social Security, according to the 15th Annual Transamerica Retirement Survey.

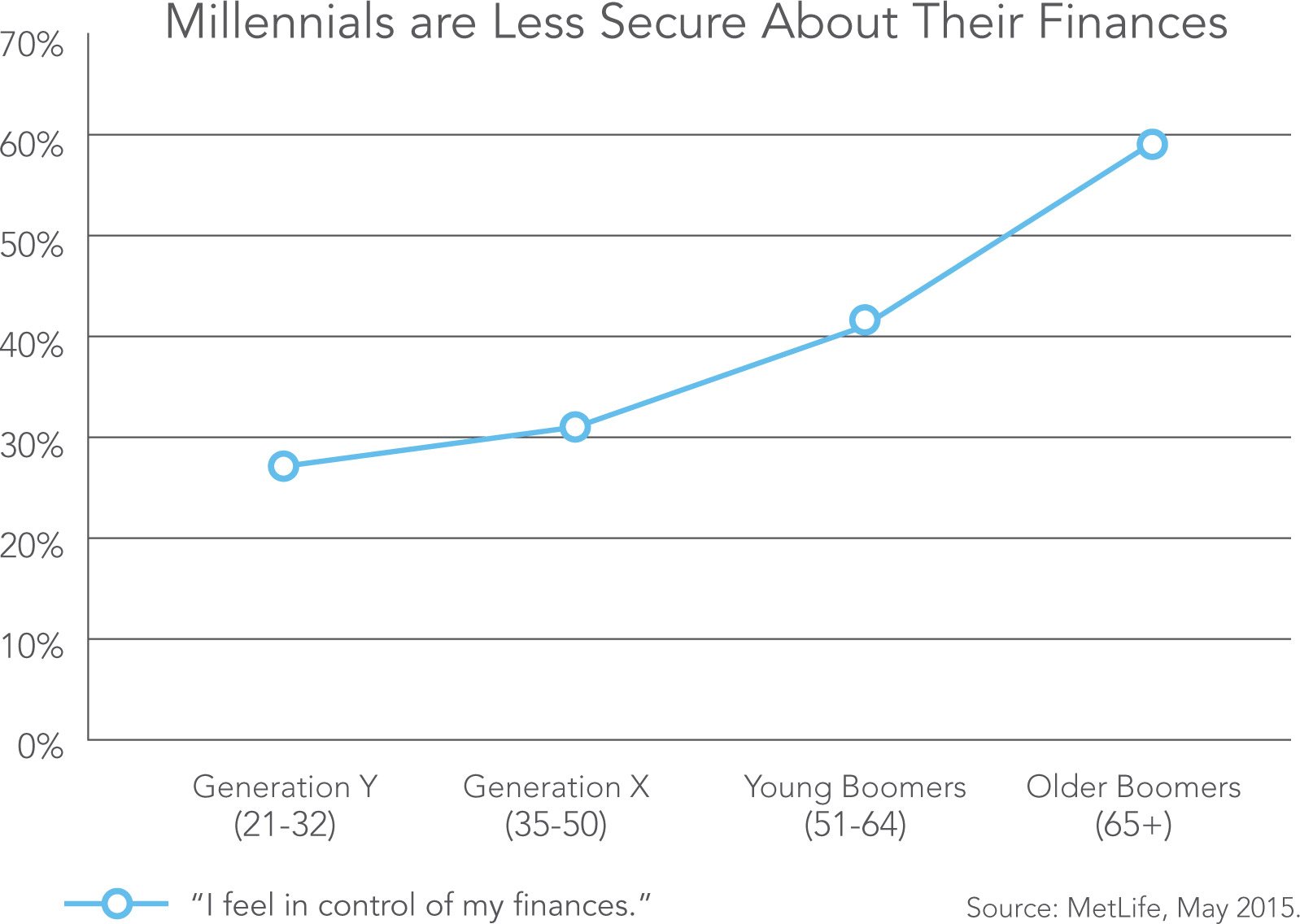

So it’s not surprising that the MetLife 2014 and 2015 Benefit Trends Study found that millennials are the generation that feels least in control of its financial wellness.

Financial stress is bad for business

Stress can affect not only the millennials you want to hire, but the employees already on your payroll. A 2014 survey of HR professionals by the Society of Human Resource Management (SHRM) found that 41% of HR professionals reported that a lack of monetary funds to cover personal expenses affected employees at their organizations. The same SHRM survey found that personal financial challenges affect employee performance. Half of respondents said that financial concerns resulted in employee stress, and nearly as many (47%) said there was a corresponding inability to focus on work.

Improving employees’ financial wellness and education benefits may help you bring in new talent and improve productivity among the talent you already have.

How to come out on top

If you're hiring millennials, you can make your employment offer more appealing with benefits that support financial literacy and stability. It's not enough to offer traditional retirement benefits — few millennials plan to stay with one employer long enough to take advantage of them. However, they are very interested in financial education.

How you present financial wellness to millennials matters as much as the content. When was the last time you saw a millennial reading a paper book or newspaper? (Hint: likely never.) They get their information electronically, typically on a smartphone or tablet — so plan to skip printed brochures. They also like edutainment: 90% of millennials play online games on their mobile devices, making gamified financial literacy programs (like many financial literacy apps) perfect for younger workers.

Chances are, your financial wellness and/ or retirement plan partners offer online and mobile-friendly financial tools and resources. It's worth a conversation about the tools they provide and how you can promote them as part of your recruiting efforts, and to better engage your existing workforce.

The payoff is a workforce that is less stressed, more focused, and more productive — all of the same returns you get from a health and wellness strategy. So it makes sense to expand wellness to include financial wellness for existing employees and to market it to potential recruits as well.

RELATED RESOURCES

Welcome to ADP TotalSource, a modern way to manage, engage and unlock your workforce.

Partnering with ADP TotalSource is like gaining your very own highest-grade HR department to adapt to and support your business's growth. From helping you stand out to attract and keep top talent to offering competitive benefits that rival Fortune 500® company packages, ADP TotalSource can provide what you need, when you need it.

Backed by the big-data power and reliability of ADP, yet designed to be nimble, scalable and adaptable to fit your precise objectives, ADP TotalSource is a personal extension of your business to help you manage and engage your team, mitigate compliance risk, and stay ahead of the competition.

LIMITED TIME OFFER:

No Setup Fee (up to $2,500 value!)

(844) 520-9669

(All fields are required.)

The ADP Logo and ADP are registered trademarks of ADP, LLC. All other trademarks and service marks are the property of their respective owners. ADP, LLC.